What are Financial Pre-Approvals?

An effective pre-approval comes to contacting a mortgage lender before making an offer with the a property. In this processes, you done a mortgage app detailed with information about your own funds. After that, that loan underwriter studies debt data files and commits to help you getting a loan up to a quantity.

Getting a pre-acceptance also offers multiple trick professionals. First, they accelerates brand new homebuying process. Rather than the normal 29-big date closure period, you will be capable close-in simply 14 days, allowing you to act easily as you prepare and then make an enthusiastic offer. Which rate will provide you with an aggressive border, especially in a good seller’s markets. Sellers and you will real estate agents prefer working with pre-approved consumers because simplifies the process and reduces the exposure out of delays from financial activities. Good pre-acceptance suggests vendors that you’re significant and prepared because it gives them depend on that contract will intimate effortlessly. In addition, realtors could work more proficiently having pre-acknowledged website subscribers, helping you see house affordable.

Pre-approval plus provides you with a clear comprehension of your resource just before you begin household google search. You will understand how much you really can afford plus the terms of your loan, you wouldn’t spend your time deciding on land external your financial budget.

What do Loan providers Feedback to have Pre-Approvals?

In pre-acceptance processes, the financial institution takes into account your revenue, credit rating, bills, and you can a position records. Specifically, it remark your history one or two spend stubs, last several lender comments, last 2 years from W-2s and you can tax statements, and you may creditworthiness.

The credit examine pertains to more than just examining this new borrower’s three-fist credit history (or FICO get). Lenders dig greater on the products like credit score, quantity had, borrowing from the bank use proportion, credit score, borrowing merge, https://paydayloancolorado.net/el-moro/ and brand new borrowing from the bank.

Preciselywhat are Minimal Requisite Down Costs?

In pre-approval processes, this new percentage of your own minimal required advance payment is decided. So it count varies for every individual and depends on your unique affairs, rather than staying with a basic guideline. But not, understanding the fundamental guidelines can always give worthwhile wisdom.

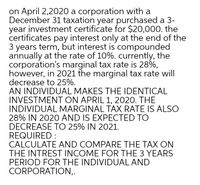

As previously mentioned from the infographic a lot more than, minimal called for advance payment payment getting a beneficial FHA loan are normally step three.5%, a figure dependent on the fresh new Government Houses Administration (FHA). So it basic makes FHA funds a greatest alternatives certainly basic-time homeowners employing lower down commission requirements plus versatile borrowing from the bank qualifications.

Va home loans excel to own perhaps not requiring a minimum off fee, as a result of the support of the Company of Pros Products. So it service produces homeownership even more obtainable getting army service professionals and you will the partners. From the waiving the fresh new down-payment specifications, Virtual assistant loans break down monetary traps very veterans in addition to their parents can achieve their dreams of homeownership.

Meanwhile, getting old-fashioned loans, the minimum called for advance payment are solely according to research by the lender’s standards in addition to particular terms of the loan (usually hovering around 5%). But not, discover exclusions. Including, mortgage candidates that happen to be first-go out homeowners (Otherwise have not had property before 36 months) exactly who earn lower than otherwise equal to 80% off county city average income could possibly get be eligible for less minimal advance payment out-of step 3%.

A profile loan will most likely not you want a downpayment, for this reason minimal commission happens as low as 0% on infographic. Portfolio fund are primarily chosen from the dealers or individuals when they have novel needs maybe not found by the most other loans. In lieu of conventional mortgage brokers sold in order to people, portfolio loans try remaining because of the bank. Allowing all of them become more versatile, meaning they can loans a lot of pick.

Must i rating a mortgage Pre-Recognition on Academy Financial?

From the Academy Financial, you can expect an array of tips to assist you during your house to buy process. Regardless if you are an initial-go out client, undertaking the new pre-acceptance process, or maybe just examining financial solutions, all of us will be here to assist you every step of one’s method.

Make sure you make the most of our very own on the web financial hand calculators-for instance the mortgage qualifier calculator, home loan calculator, and you will home loan research calculator-to higher discover your financial possibilities.

Prepared to start? Help our very own knowledgeable mortgage benefits and loan advisers guide you into getting together with your goal of homeownership!

Leave a Reply