These types of terms and conditions will tell the total amount you are credit, the speed, in addition to installment schedule. Yet not, unlike make payment on cash return to a bank otherwise bank, you’re paying off they back to their retirement account. ?Instead of most other old-age membership withdrawals, you don’t need to spend taxation otherwise charges so long as your pay the loan depending on the cost terminology. ?

Eligibility standards

While you are zero credit score assessment is needed to feel acknowledged to own a good 401(k) loan, there are specific eligibility requirements that must be came across.

When you yourself have an excellent mortgage and wish to shell out it off prior to requesting a separate one, you certainly can do very for the Money page of your fellow member dashboard.

Financing minimums and you can restrictions

That have a 401(k) mortgage, there are certain restrictions in order to exactly how nothing or exactly how much you can be borrow. ?The minimum amount try $1,000. The absolute most hinges on your account harmony and whether or not you had another type of financing prior to now 1 year. ?The formula to own choosing the most is the cheaper out-of:

Analogy 1: Graham possess an excellent vested balance off $75,000 features never pulled financing from his 401(k) bundle.?The absolute most he is able to take is the decreased from:

The most mortgage Graham takes are $37,five-hundred bad credit loans in Fairmount CO.??Example dos:Yasmin features an effective vested balance off $250,000 and you may paid back their past mortgage out-of their 401(k) package a couple of years ago.?The maximum amount she will take is the reduced away from:

The utmost loan Yasmin usually takes try $fifty,000.??Example 3:Ryan provides an excellent vested balance out of $250,000. Four months before, he paid off their a good 401(k) financing having a cost out-of $25,000. Now, he would like to sign up for another mortgage.?The maximum amount the guy located ‘s the cheaper of:

Cost words

In case your mortgage is approved, you’re going to have to pay-off the fresh lent balance that have appeal, that is 1 payment part above the current best speed. Please be aware that most attention goes actually back again to your bank account for your benefit. ?Loans have to be repaid within 5 years, or ten years in case it is towards purchase of a primary house. ?To possess financing conditions beyond 5 years, you’ll want to fill out one of several following data files to Tip along with the financing consult:

A duplicate in your home pick contract signed on your part and you can the vendor, such as the closing time and harmony of the cost, or

Or even pay off the borrowed funds, together with notice, depending on the financing terminology the borrowed funds might be a deemed shipping. One unpaid quantity after that be taxable (and will be susceptible to an excellent 10% very early shipping penalty).

For individuals who leave your existing employment, you may be expected to pay back any a great financing balance inside the complete inside 90 days, or your loan becomes a taxable shipments (and may feel susceptible to good 10% very early delivery punishment).

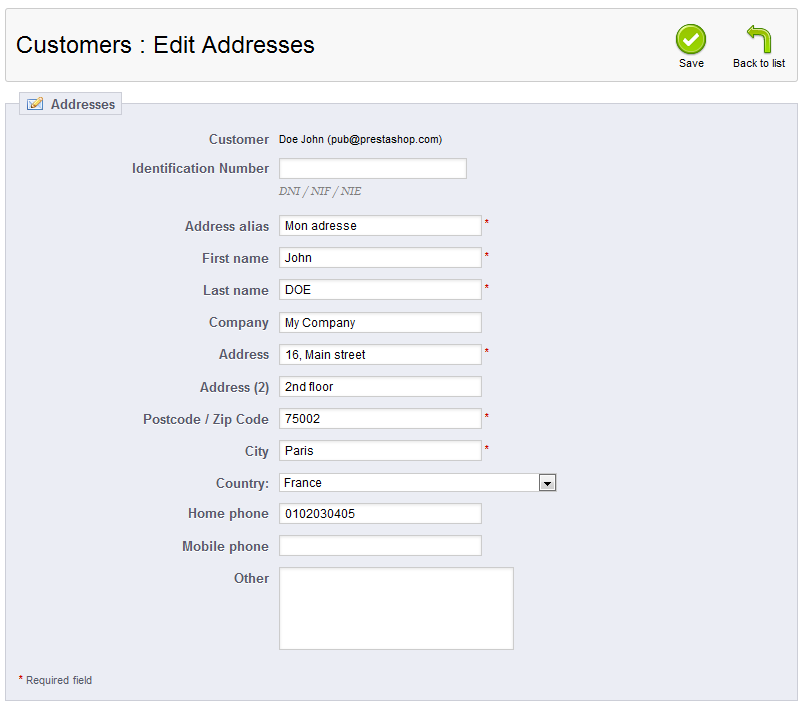

You’ll then be given every withdrawal solutions in order to you, together with information about for each. Whenever you are qualified to receive a loan, come across you to solution towards webpage. For those who aren’t qualified, the borrowed funds solutions was grayed out, and you will discover a reason from why.

You may then get very important terms or details out-of a 401(k) financing. After you’ve read through what, click the button to maneuver submit, and you’ll be guided through the app process.

After you fill out a loan request, you can preserve monitoring of the position because of the opening the activity page within the Transmits eating plan. Additionally, you will discover email notifications since you hit more goals into the the loan processes, instance when your app has been accepted otherwise if the fund take the way in which.

Leave a Reply