At the rear of all of the household purchase is a significant financial cooperation. In more recent years, co-possession is more common, including teaming up with family unit members otherwise loved ones. However, understanding how most people will likely be towards home financing was crucial to determining what you are able get to together, and you may things to thought one which just jump in.

According to JW Surety Securities, nearly 15% out of Us americans interviewed provides co-ordered a home which have a person apart from its close spouse, and one forty-eight% do contemplate it. Given that shared mortgage loans give enough gurus, he or she is a stylish solution to some-financial responsibility is actually shared, borrowing strength is actually increased, and you can big fund which have top interest levels is generally significantly more possible whenever pooling information that have another type of people.

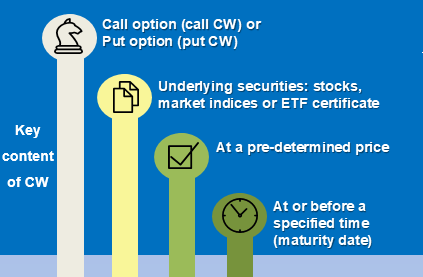

To higher understand the particulars of co-borrowing from the bank, co-signing, otherwise co-buying, let’s define several things, like the joint home mortgage.

Understanding Joint Mortgage loans

A mutual home loan is a home loan agreement having a couple inside. New individuals finalizing the mortgage try sharing obligations into mortgage fees. Remember that this is unlike shared ownership, that’s often regularly stop establishing someone into the financing on account of a diminished credit rating (locate a better rate of interest and qualify for a top amount borrowed). Just one user’s label will appear toward financial, even if each party theoretically own new asset.

An easy way to Bring Identity Which have Several CO-Individuals

Clients in common. Every co-debtor try a proprietor, however, per share tends to be marketed based on simply how much they lay out on down payment or just how much they contribute for the monthly homeloan payment.

Financial Eligibility to own Combined Applicants

The whole process of making an application for a shared home loan is much like the process you would predict if you were taking out home financing alone. The financial institution will need under consideration any profit: your credit score, income, a career records, plus present bills. The lending company commonly consider every person’s credit score to choose which financing the group often be eligible for.

Different people wishing to get on the mortgage must complete a great independent application.But how the majority of people will be towards financing, exactly?

How many Someone Are going to be On A mortgage?

Typically, no more than 4 or 5 co-individuals are generally allowed to the home financing. Because of the software employed by Federal national mortgage association and you may Freddie Mac, the latest constraints was fundamental unlike courtroom. There could be, the theory is that, so much more individuals using one financing for those who receive a loan provider to help you underwrite the loan without using that minimal software. not, most loan providers doesn’t exceed five co-consumers having a conventional mortgage.

It would be moreover to consider brand new judge and you will logistical aspects of integrating which have several functions into the a home loan.

Considerations In advance of CO-Credit

Prior to signing on the dotted range, consider long and hard concerning implications regarding mutual ownership and common debt. How well have you any idea those individuals you’re co-borrowing from the bank that have? As everybody’s financials basis towards the acceptance, you to definitely outlier you are going to lower the quantity you can use otherwise alllow for a diminished interest rate, contributing to all round pricing along side life of the mortgage.

On the other side of one’s money, Several co-individuals on a single loan can perhaps work well for these instead of because the much monetary balance and you can highest credit rating-enabling them access to new homeownership path. In addition, a team you can expect to sign up for a more impressive loan amount to pay inside a multi-unit building to reside in and you can rent out to own inactive money.

Legally, co-credit will be tricky. Such, good shortly after-partnered few going right through a separation is now able to must often offer your house, pick out of the most other companion, otherwise separated this new continues off leasing.

Essentially, if a person co-borrower wishes aside (or has gone by out), the remainder co-consumers need dictate the following methods together. Which will are to find all Candlewood Lake Club loans of them aside, attempting to sell the show, otherwise refinancing to possess its label taken out of the loan-in which case you could end up with a top focus rate.

Why does Cosigning Connect with The Borrowing?

In a nutshell, getting a great cosigner has the capacity to affect their borrowing from the bank. Brand new team you happen to be cosigning getting make a difference to your credit score that have the financial obligations. When they promptly with home loan repayments, their score may go up. Having said that, if they’re later otherwise at the rear of towards mortgage payments, your own score might have to go off.

Difference between A great CO-SIGNER And you can A good CO-Debtor

So you can lenders, i don’t have an impact between a co-signer and you can good co-borrower-these include each other fiscally in charge, each other factor for the qualifying amount borrowed and you can interest rate, and you may each other will be responsible if payments aren’t made on time.

not, if you find yourself applying to become an effective co-borrower, it indicates their name’s into action, whereas cosigners will not be entitled towards the deed into the assets. A good co-signer isnt region-manager.

Techniques for Enhancing Borrowing from the bank Electricity

If you’re considering with numerous anybody on the that loan, you could significantly improve the financial qualification having combined individuals-you and those your lover withbining income can get direct you can be take on more substantial loan. As well as, combined fico scores are usually averaged. In the past, a low credit rating are often concerned about many, nevertheless now, lenders be a little more willing to mediocre from the credit ratings so you can look for a pleasurable average of all the credit ratings.

Having said that, consider the borrowing from the bank users, revenue, and property of one’s co-borrowers seriouslymunicate well and frequently up to your financial early in the day, introduce, and upcoming to find a far greater concept of the place you you will house if you would like sign a combined home mortgage. Remember: With more someone happens a whole lot more views and much more monetary complications to go through.

When you are ready to explore joint financial choice, contact the new PacRes financial masters now to possess customized information and choice that suit your position-therefore the needs of one’s co-borrower or co-signer!

Leave a Reply