The newest shared effectation of high coupons plus financial obligation can be once more disagree ranging from home with various habits. Type of B households, whom lead significantly more having a good 401(k) financing alternative than simply as opposed to, often see quicker senior years deals compared to a posture in which credit out of an excellent 401(k) plan wouldn’t be you can easily. Kind of A people, exactly who let you know behavior in line with enhancing monetary consequences, almost certainly find yourself with a lot more total coupons of the higher share cost than are the situation if the credit from a 401(k) package was not an option, although it enhance their full quantity of financial obligation.

Plan effects

They can save your self on their own and obtain of by themselves on same monetary device. Current browse to the implications of capacity to use out of a beneficial 401(k) loans is somewhat minimal, just a few trick results that are out of rules significance appear nonetheless.

Very first, 401(k) loans fill a life threatening character on economic security of house. They have a tendency in order to rely on people fund for many explanations, particularly for purchasing healthcare or any other consumption when a household associate is ill. Getting rid of the ability to borrow out of a great 401(k) plan you are going to hence produce ample financial hardships for the majority domiciles just who already strive financially.

Next, restrictions into the 401(k) finance would be to stay-in place. There is no proof that home frivolously obtain off their 401(k) loans-the potential for borrowing from the bank and you will loan wide variety try reasonable, although both was expanding over time. And you may realization analysis towards reasons for taking out fully this type of money mean that really finance was pulled for high-measure plans whereby other mortgage options are both high priced or do not exists-with the downpayment on the a primary household, having college degree, and healthcare and you can related application, such as for example. Existing financing limitations, especially to the reasons for having taking right out that loan of a 401(k) mortgage, appear to work and policymakers need to keep those in lay.

Third, there may be place to bolster the hyperlink anywhere between a borrowing alternative out of and you will efforts in order to an effective 401(k) plan. The evidence means that the web link is especially good having home exactly who currently handle the cash well, given that link was weakened to own homes just who appear to challenge into the managing the earnings various other portion. That chance is to result in the borrowing from the bank choice contingent on the early in the day efforts. An idea who may have a standard sum speed regarding 3 per cent away from money, by way of example, you will definitely grant personnel the choice to help you use using their 401(k) bundle if they discussed four fee circumstances way more-which is, when they shared at the very least seven per cent of earnings inside the previous 1 year or two years. The excess benefits you will are very different and could be phased during the over time as long as someone needed seriously to contributed more income in order to gain access to the loan solution within 401(k) agreements. New borrowing from the bank choice create no longer exist if the contributions was to the mediocre less than the minimum inside the research-right back several months.

To be able to use from your 401(k) package can prove valuable so you can domiciles in proper affairs. And you may policymakers is also put the fresh new terminology to ensure property is also equilibrium present needs and you can future need along with their retirement offers for the a considerate style.

Christian Elizabeth. Weller is actually an elder Other in the middle to own American Improvements Step Finance and you will a teacher in the Institution out-of Personal Policy and you may Personal Issues during the College of Massachusetts Boston.

The new ranks out of Western Improvements, and you may all of our plan professionals, is separate, and also the conclusions and you can conclusions shown are those out-of American Advances alone. An entire range of supporters can be found right here. American Advances wants to recognize the countless good supporters which make the work you are able to.

Inclusion

The extremely blended evidence into the 401(k) money points to multiple public plan classes. First, 401(k) fund complete a life threatening role to your economic coverage out of home. They have a tendency to help you have confidence in men and women loans for a lot of grounds, and expenses expenses when a family group affiliate was unwell. Reducing these types of fund you certainly will thus end in big financial challenges for many homes.

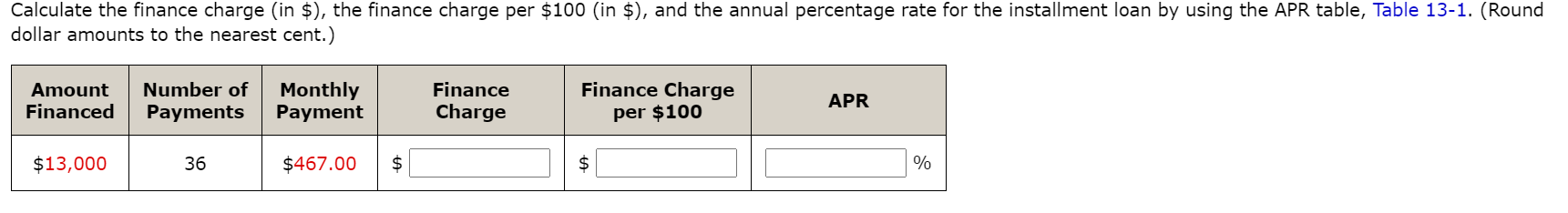

Dining table step one sumount of 401(k) finance this year, the past year by which data in the Federal Set aside try offered. This type of data show a beneficial a dozen.1 percent threat of that have an excellent mortgage in 2010 if the the family have a good 401(k) plan-the best show with the number, dating back to 1989. As well as the mediocre amount borrowed totaled $thirteen,976 this season, that is once again the greatest on number.

So it effects contributes to a glaring implication off 401(k) funds. Homes can get deal with monetary demands in the present one to push them so you’re able to borrow using their senior years discounts agreements. Nevertheless the exact same challenges will get sluggish payment of one’s mortgage and you may build more 401(k) package efforts outside of the loan money hard. An effective 401(k) loan essentially strikes brand new stop button with the accumulating brand new senior years offers and you will gaining access to a few of the taxation benefits associated with an effective 401(k) plan until the financing are completely reduced. Progressive payment together with shortage of extra 401(k) contributions not in Arizona loans the mortgage money is also hence drastically sluggish retirement savings accumulations. The exact effect off an excellent 401(k) loan for the total old age deals depends on the pace billed into the loan, the speed attained to the savings, perhaps the debtor possess with efforts to the later years discounts plan as well as paying down the mortgage, of course, if the mortgage is actually taken out. A loan removed early in a worker’s occupation can lessen retirement deals by more than 20%, particularly if there are no a lot more 401(k) contributions beyond the financing money.

This research further finds out you to acquiring the substitute for obtain out-of an excellent 401(k) loan is additionally of this much more complete financial obligation. You to definitely reason would be the fact domiciles, that have the option so you can borrow using their 401(k) agreements, can get borrow more on its handmade cards and mortgages than other property as they remember that they can fall right back on the 401(k) preparations once they find difficulties inside settling their non-401(k) loans.

Leave a Reply