Of several lenders favor to not ever provide to consumers that have fico scores throughout the Bad variety. Thus, what you can do so you’re able to borrow money and you can capital choices are browsing getting very restricted. That have a rating from five hundred, their interest are into the building your credit report and you will increasing your fico scores before you apply for money.

One of the best an approach to create borrowing from the bank is through being added given that an authorized user by an individual who currently possess great credit. With anyone that you experienced with good credit that may cosign for you is also a choice, it can be hurt the credit rating for folks who skip costs or standard toward financing.

Would you get credit cards having a 400 credit history?

Credit card individuals having a credit rating contained in this assortment may be required to establish a security put. Applying for a protected charge card is probable your best option. But not, they frequently want deposits away from $five-hundred $1,000. It is possible to be able to get a beneficial starter mastercard off a card union. It is an unsecured charge card, but it boasts the lowest credit limit and you will highest attention speed.

Either way, when you’re able to find accepted to have a charge card, you must make your payments punctually and keep maintaining what you owe less than 29% of credit limit.

Do you rating a personal loan with a credit history from 500?

Few lenders often approve your to have a personal loan that have a 500 credit rating. But not, there are some that work with less than perfect credit consumers. However,, personal loans from the loan providers come with large interest levels.

You need to end pay day loan and you can higher-interest unsecured loans as they create long-label obligations difficulties and simply contribute to a deeper decrease in credit score.

To construct borrowing, trying to get a cards creator mortgage is generally advisable. In the place of providing you with the money, the cash is actually listed in a family savings. Once you pay the mortgage, you have access to the bucks also people desire accrued.

Do i need to rating home financing with a credit rating of 500?

Old-fashioned mortgage lenders will most likely decline the application that have a credit score regarding five-hundred, just like the minimum credit score is approximately 620.

But not, for these finding applying for an FHA financing, applicants are merely necessary to has actually the very least FICO rating out of five-hundred so you can be eligible for a downpayment of about ten%. Individuals with a credit rating out-of 580 can be be eligible for an excellent advance payment only step 3.5%.

Can i score an auto loan having a 500 credit rating?

Extremely car loan providers will not provide so you’re able to people that have a 500 get. If you are able to find accepted to own a car loan that have a 500 get, it could be pricey. When you can boost your credit score, bringing a car or truck will be convenient.

How to Increase a 400 Credit score

A woeful credit get usually reflects a track record of borrowing from the bank errors or mistakes. Such as for example, you’ve got certain skipped repayments, costs offs, foreclosures, and even a personal bankruptcy appearing on your credit report. Additionally, it is possible that you just haven’t centered borrowing from the bank anyway. Zero borrowing from the bank is pretty much exactly like poor credit.

step 1. Conflict Bad Membership in your Credit history

It’s best to grab a copy of one’s 100 % free credit report out-of each of the around three big credit reporting agencies, Equifax, Experian, and TransUnion observe what is actually becoming stated about yourself. If you learn one negative affairs, you can also hire a credit repair organization instance Lexington Laws. They’re able to make it easier to conflict them and possibly have them removed.

Lexington Legislation focuses primarily on removing bad things out of your credit report. He has more than 18 numerous years of feel and have now got rid of over 7 billion bad factors for their readers inside the 2020 by yourself.

- difficult issues

- late repayments

- collections

- charges offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

dos. Take-out a card Creator Financing

Borrowing from the bank builder money is cost fund which might be specifically made so you’re able to assist individuals with poor credit generate otherwise reconstruct credit history. Indeed, borrowing builder fund none of them a credit score assessment after all. Along with, it should be the least expensive and you may easiest way to improve their credit ratings.

That have borrowing builder finance, the bucks consist in the a savings account up to you’ve completed all the your own monthly payments. The borrowed funds repayments try stated to at least one borrowing from the bank agency, that gives the fico scores an improve.

step three. Score a protected Bank card

Just like the talk about prior to, bringing a guaranteed charge card is a wonderful answer to establish borrowing. Secure playing cards works comparable just like the unsecured handmade cards. Really the only huge difference is because they require a protection put that also acts as their borrowing limit. The credit card issuer could keep the put for individuals loans in Limon who stop deciding to make the minimal commission or can’t shell out their mastercard balance.

4. End up being a third party User

When you find yourself next to anyone who has sophisticated borrowing from the bank, getting a third party associate to their borrowing from the bank account, ‘s the fastest cure for boost your credit scores. Their username and passwords will get set in your credit score, that can improve your fico scores instantly.

5. Generate Borrowing by paying The Book

Unfortuitously, book and you can electric payments aren’t usually claimed on credit bureaus. But not, having a small percentage, rent revealing qualities can add on your repayments toward credit history, which will help your alter your fico scores.

Which place to go from this point

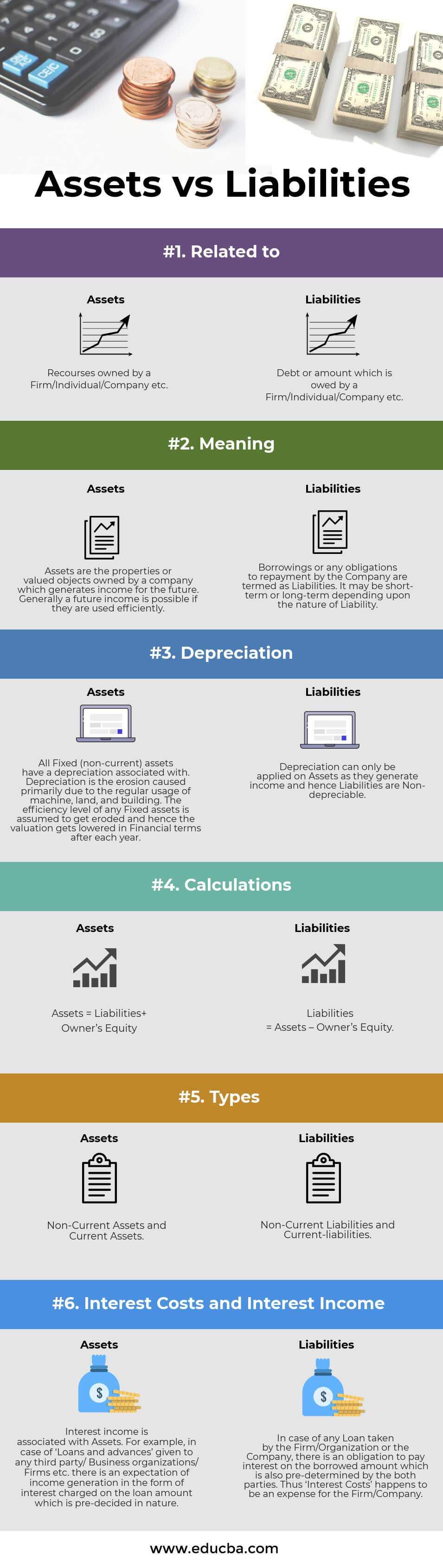

It is important to know which items compensate your credit rating. As you care able to see on the image less than, you will find 5 affairs that comprise your credit rating.

Reduce your stability and keep maintaining your borrowing from the bank usage below 30%. Its also wise to features different kinds of borrowing from the bank profile so you’re able to introduce a very good borrowing merge since it is the reason doing 10% of your own FICO get. Thus, you need to keeps one another repayment and you may revolving borrowing popping up on your credit report.

Of course, you also must run and make prompt money from this point towards aside. Also one late commission can be hugely damaging to your borrowing from the bank.

Length of credit history in addition to performs an essential part on the credit scores. We want to reveal possible loan providers that you have a long, self-confident fee records.

Strengthening a good credit score doesn’t takes place straight away, but you can of course automate the method by creating the fresh new correct movements. Very bring Lexington Legislation a need a no cost borrowing consultation at (800) 220-0084 and get come restoring their borrowing today! The sooner you begin, the earlier you’re going to be on your way to that have good credit.

Leave a Reply