We now have worked with many users to design and build its dream domestic — the one that suits almost all their means when you are becoming in this funds.

But in all of our a lot of conversations having coming homeowners, the best matter we get was: It music high, but exactly how carry out We pay it off?

A natural question, in reality. Building a bespoke home is generally good once-in-a-existence experience. Capital the development is the spouse of developing it a beneficial facts.

Of course, regard to so it mortgage method of spurs other concerns. Let’s search into the financial support a custom home build with a brand new domestic design mortgage.

1. Framework Mortgage

Generally speaking a short-name loan with a higher interest, construction financing pay only for strengthening a house. They safeguards the build-related venture expenses, from setting up the foundation to creating the roof trusses. Structure funds do finance almost every other costs away from a bespoke home investment , including to shop for a lot or surroundings.

There is any where from two so you’re able to 10 pulls allotted from inside the a houses financing. Your accrue attract on financing which might be disbursed consequently they are responsible for and then make notice-only money to your financial whenever you are you reside done.

That loan structured having less brings get give you in control so you’re able to spend contractors initial before the expected milestone is actually met to release next draw. Coping with best financial and you can wisdom your options is vital!

Framework funds try awarded which have a period of time restriction, always as much as half a year, doing the project. Identical to looking a loan provider, going for a skilled creator or standard specialist is required to generate yes the project is performed timely.

Compared to most other actions, like stick strengthening otherwise modular construction , Barden’s panelized home framework makes for a far better and you can reduced create. Every heavy-lifting is accomplished inside our factory where in fact the panels and you will trusses try made since your site is ready. Building which have boards normally shave weeks of your project.

Like any major investment, you can find details that impact design time, including climatic conditions and you may builder access towards you. Remember, the brand new less time spent building you reside a shorter time brand new construction mortgage should accrue interest.

2. Old-fashioned Mortgage

Abreast of conclusion off structure, the construction financing try transformed into a routine amortized financial (permanent funding). You’ll pay dominant and you may attract through the duration of the borrowed funds.

In which Must i Rating a construction Loan?

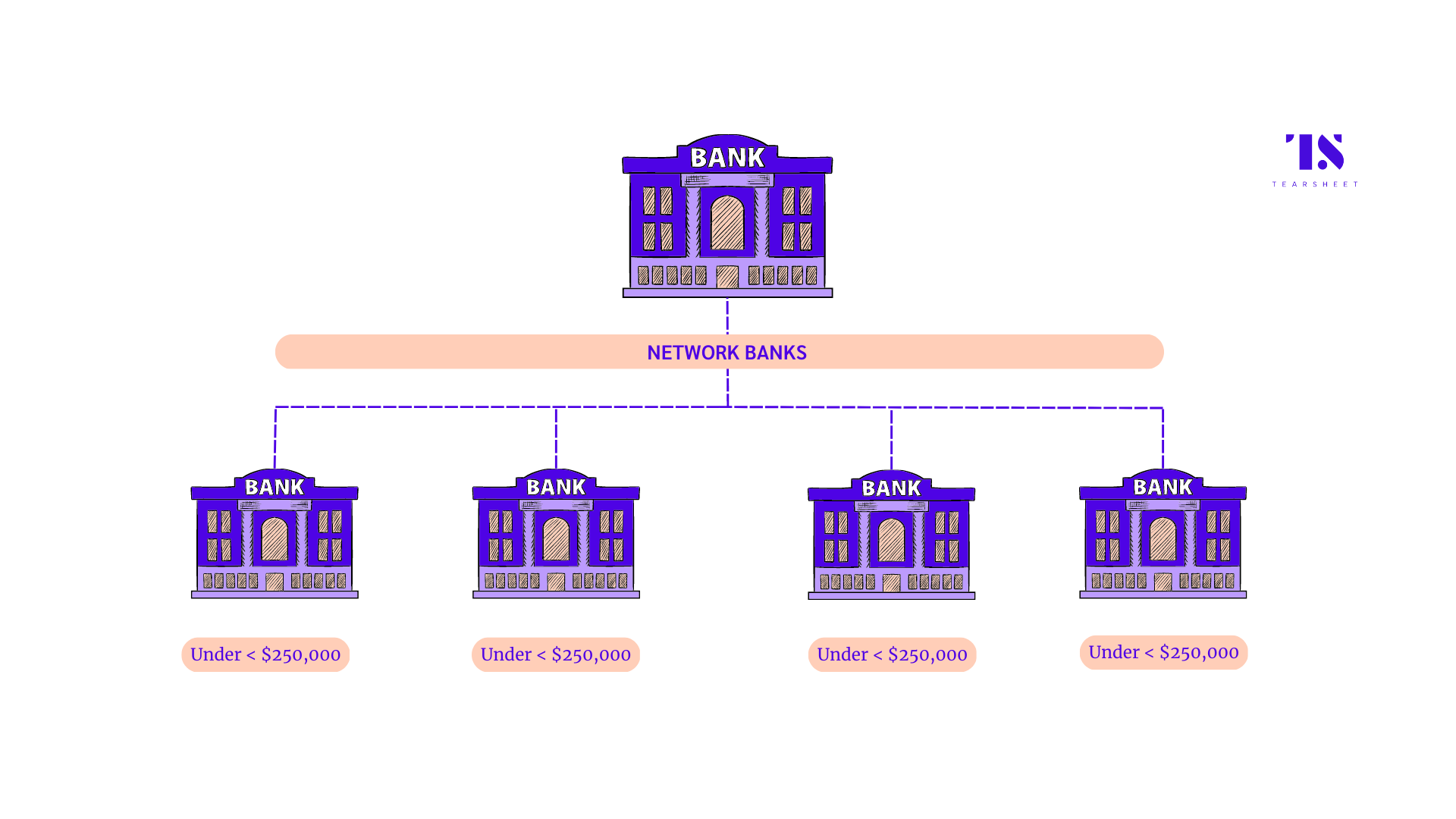

Not totally all major banks promote structure fund. Quite a few people who’ve shielded a housing mortgage by way of a bank are using local or local establishments.

Banks who do offer structure loans constantly simply include as much as five draws in their packages, placing an economic strain on the buyers.

Shopping for a third-team financial will be challenging. There are many out there for almost most of the goal. Yet not, there are numerous legitimate and you will depending 3rd-class loan providers one to interest strictly towards the financing for new custom-built home construction.

Identical to researching a great bank’s construction financing, it is vital to waste time looking at new terms and conditions off a third-class lender’s funds. The last thing an alternate individualized homeowner desires is usually to be stuck that have an extended-identity mortgage that produces lives more complicated.

You shouldn’t be frightened to inquire of an abundance of issues and ask for sources from the local agent — there isn’t any shame for the doing all of your research to be certain you’ll get that loan you could accept.

Doing a custom-built home That suits Your allowance

Just like the a company with ages of experience in the home strengthening team, we love permitting future home owners would its 2nd home.

There are a lot of variables that determine what the cost to create a custom-built home turns out since. Working with we, you’re in the latest driver’s seat with quite a few of one’s circumstances spanning the final price.

We out of inside the-home writers and singers and you may all of our Barden Independent Investors are happy to work with you to generate a property that fits the budgetary factors.

Financial support Their Bespoke home Generate Venture

Strengthening a bespoke home is a significant performing. And all of the weather that go into the taking they out of design so you can fact is actually items you want to get correct brand new first-time — you have got to reside in your domestic, at all.

Identical to dealing with credible designers and you can trustworthy suppliers, securing financial support that fits your needs is one of the most crucial components of the home-building process.

Down load the credit Book

Should find out about financing a bespoke home build? Our very own Custom-built home Financial support Publication is a fantastic step two. West Virginia payday loans It will take a further dive toward:

- The the brand new framework mortgage process work

- How your home creator/Barden dealer will get reduced

- A homes schedule simply to walk you from the process

- And!

Leave a Reply