Is it possible you believe specific bank will likely be foolish adequate to cover 97

Bubba Johnson is an excellent ‘ole boy and an unethical genuine house developer. The guy wants to generate some accommodations in the Atlanta, very the guy applies to Regional Southern Financial to possess a beneficial $dos billion industrial structure financing. Have a tendency to the guy qualify? Does the guy have enough regarding his or her own money about contract? Put simply, does the guy have sufficient skin in the online game?

The guy only set-out $75,000 inside the bucks, together with vendor carried straight back an excellent $175,000 contract out-of selling (consider a contract regarding sales while the merely a first financial carried straight back from the vendor). Regarding now some of you are probably convinced, “Hmmm, this isn’t always a carry out-ready deal. Extremely banks need the developer in order to lead brand new belongings towards the endeavor 100 % free and you may obvious (or perhaps quite close).”

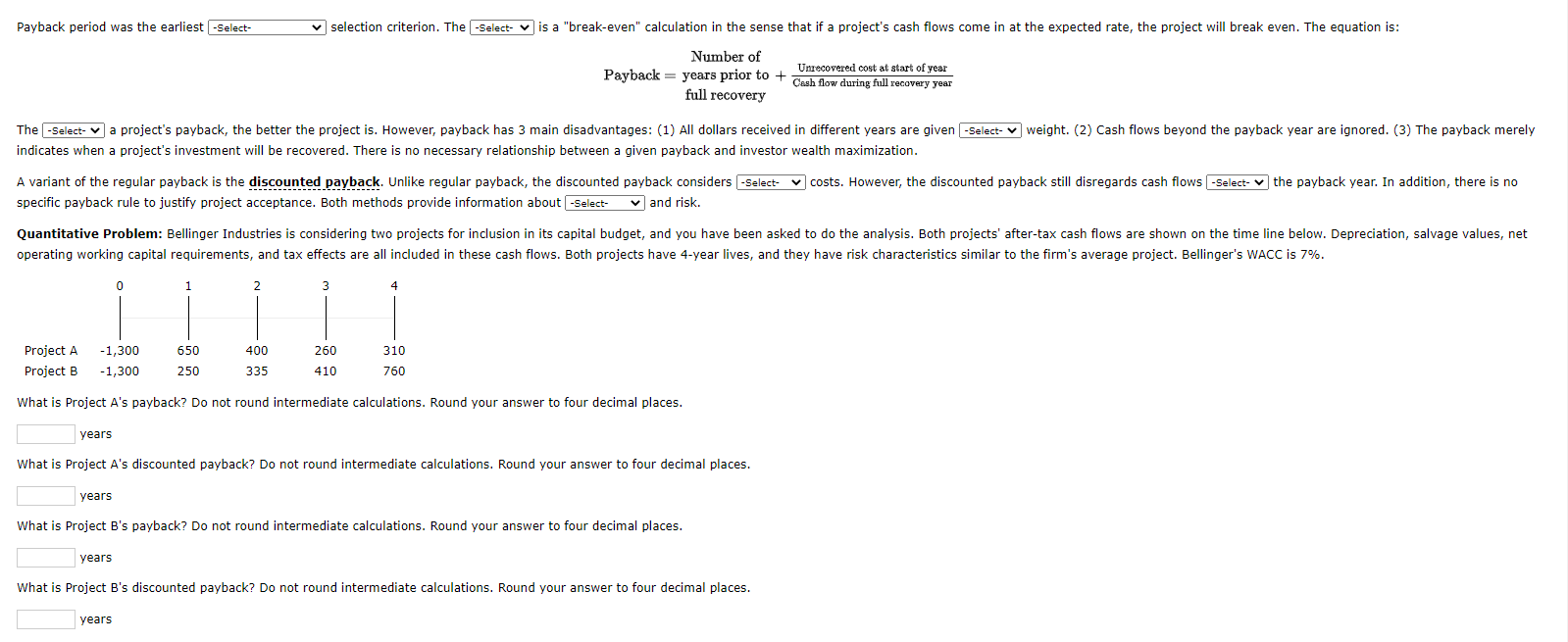

Continuous with your example. Bubba gets offers and you can submits a painful costs review of $step one,300,000. Their estimated softer can cost you, as well as structure months appeal, is $410,000. A backup set-aside of five% out of hard and you may silky will set you back might be $85,500. Our company is today ready to calculate the Endeavor Prices.

Pleased because a peacock, dubious Bubba sits off with his banker and you may suggests your the latest $334,100 cashier’s glance at off assuming, ‘ole Grammy Sara

8% of your own price of some risky structure financing? Definitely maybe not! The overall signal is this: Banking institutions typically wanted new creator to fund no less than 20% of your total cost away from a professional structure opportunity. That’s a fairly crucial sentence. You may want to read it again.

Okay, how much dough will Bubba must subscribe to get which flat strengthening created? Answer: At least twenty % of one’s full investment pricing. Okay, let us do the wide variety. We know the full Price of the project of a lot more than.

Now the only real cash you to slimy Bubba provides in the deal up to now is the $75,000 which he set-out towards the homes. He’s small by $334,100; therefore Bubba throws into the their manilla-coloured, light-pounds around three-part match, inserts his vibrant purple pouch hankerchief, and minds over to the place to find his ninety bad credit installment loans Wisconsin five-year-old granny, Grammy Sara. Guaranteeing their a rock-solid, “guaranteed” financial support, he convinces Grammy Sara so you’re able to financial her totally free-and-obvious house and bring your new $334,100 the guy should shelter 20% of your own total price of the project.

The loan-to-Value Ratio , when it comes to underwriting a professional design mortgage, is understood to be the brand new Totally-Paid Build Amount borrowed divided from the Value of the house Whenever Accomplished, just like the influenced by another appraiser chose of the bank, all the times 100%.

Essentially financial institutions wanted it loan-to-worthy of ratio to get 75% otherwise faster with the normal commercial-funding features (leasing properties such as for example multifamily, work environment, retail, and you will commercial) and you will 70% otherwise smaller to the team features, such as for example lodging, nursing homes, and you may self storage units facilies.

“My Complete Framework Costs was basically $2,045,five hundred. Your asserted that basically you may security 20% of the total price, you might build myself a construction loan into the others. Well, I created the fresh 20%. When would you feel the legal records in a position back at my $1,636,eight hundred build loan?” requires Bubba. “Not so quick there, Bubba,” answers his banker. “You really have came across the loan-to-Costs Proportion sample, but now i also need to see the Loan-to-Value Proportion try.”

An effective grumbling Bubba writes the bank a check for $4,000 – currency he previously planned to invest in Lola Los angeles Boom-Increase and lots of nostrils candy – to purchase price of an assessment therefore the harmful statement. Five months after (the fresh appraiser try always getting back together reasons) brand new appraisal possess fundamentally come accomplished. It came in within $dos,100,000. Commonly it be enough? Better, lets do the computations.

Leave a Reply