Backed by the fresh new U.S. Service out-of Agriculture (USDA), these types of financing don’t require an advance payment, however, you can find tight earnings and you may place requirements borrowers need to see so you’re able to meet the requirements.

Paperwork requirements: Most of the applicants will have to bring proof the residency reputation just like the You.S. noncitizen nationals or licensed aliens.

Conventional money

A traditional home loan was any home loan it is not backed by a national agency. Old-fashioned loans tend to want large minimal credit ratings than bodies-supported loans and tend to be have a tendency to more strict with respect to acceptable debt-to-earnings rates, downpayment numbers and you can loan restrictions.

Records standards: Borrowers must bring a valid Social Shelter amount or Personal Taxpayer Personality Amount and additionally proof the current residency updates using a work authorization file (EAD), environmentally friendly cards or works charge.

Non-QM loans

Non-licensed mortgages was home loans that don’t meet the Consumer Financial Safety Bureau’s power to repay laws, otherwise demands one to lenders feedback a borrower’s earnings and put financing terms and conditions that they are browsing pay back. These money are generally accessible to people whom can’t qualify for antique funds, always because of less $255 payday loans online same day Vermont than perfect credit, plus they come with high rates, highest deposit minimums, initial charges or other costs accredited mortgages don’t have. And additionally they tend to become uncommon provides for instance the ability to make attention-just costs or balloon costs.

Eligible immigration statuses: Also international nationals can be be eligible for non-QM financing, as many of them loan providers do not require proof U.S. money, You.S. borrowing or a personal Coverage matter.

Records standards: You typically don’t have to provide any proof You.S. residence updates or a personal Protection count, and you can as an alternative it is possible to just need to meet the lenders’ money, deals or any other fundamental conditions.

3. Gather records

Like any homebuyer, just be happy to show your income, property, advance payment origin and you may credit history. At exactly the same time, you are able to generally need offer documents of property position so you’re able to lenders. Let me reveal a list of preferred personal information for during the ready:

> Societal Shelter amount: Extremely regulators and you will antique lenders want a valid Public Protection count in order to meet the requirements. Sometimes, just one Taxpayer Personality Matter is acceptance, but fundamentally Social Security amounts is actually common.

> Residency: Lenders like to see valid, unexpired proof of your current residence status within the You.S. This means lawful long lasting owners will need to render the green notes and you can nonpermanent citizens will need to let you know its visa or a career authorization document.

> Down payment into the You.S. dollars: Currency for your down payment and you can closing costs need to be for the U.S. bucks for the a You.S. checking account. In the event the that cash to start with came from a foreign membership, you’ll want to provide evidence of its replace so you can U.S. cash. Loan providers like to look for an everyday harmony for at least one or two weeks ahead of the application.

> Income inside the You.S. dollars: Anticipate to let you know loan providers at the very least the past a couple of years’ earnings records, usually by way of W-2s or federal taxation statements, and prove most recent a job. People payments otherwise income acquired out of a foreign corporation or an effective overseas authorities within the an alternative money need to be translated so you can bucks.

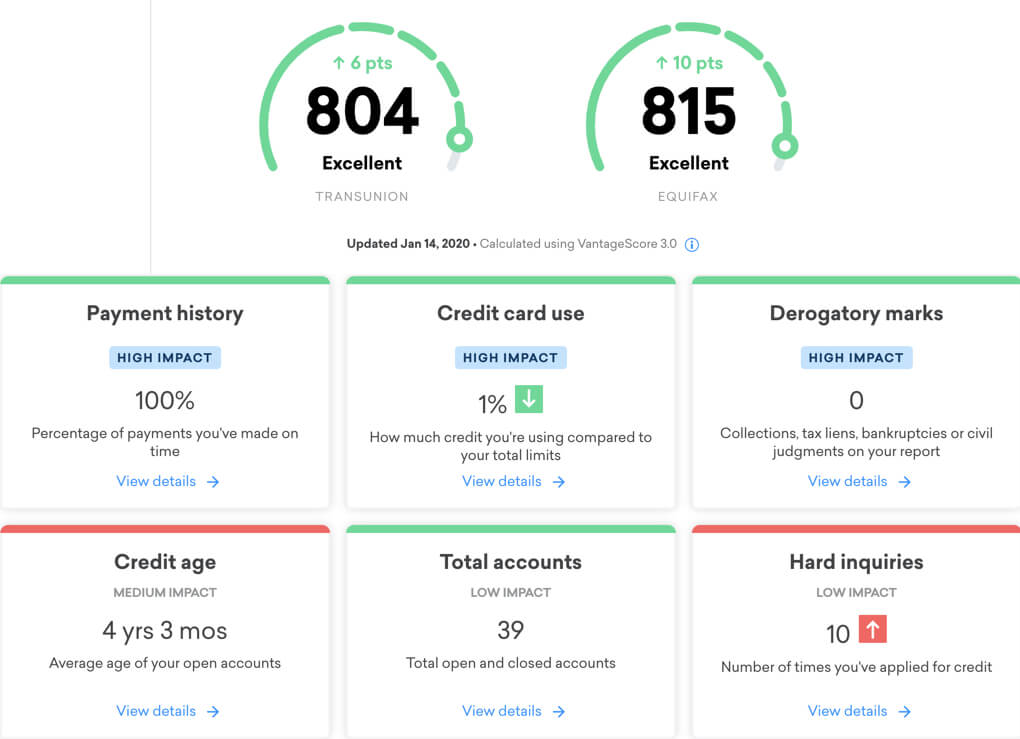

> Credit score: Lenders commonly look at your You.S. credit history and you will credit report from just one or more of the about three national credit reporting agencies: Experian, Equifax and you may TransUnion. In the event your borrowing is just too the newest on account of deficiencies in adequate You.S. credit history, their home loan company are able to use borrowing sources from a foreign nation, offered they meet with the exact same criteria to own domestic records and they are capable of being translated towards the English. Lenders also can take on a nontraditional credit rating, including the early in the day several months’ lease or electric payments.

Leave a Reply