Possessing Mobile Domestic Parks would be terrific addition into the real property portfolios away from individual advance america personal loans in Hamilton industrial investors, specifically today on the increased interest in cellular home on account of the newest reasonable homes drama. However, mobile house park control problems can be quite costly! Here are the greatest step 3 No-Nos regarding purchasing cellular house areas:

Mobile Home Playground Control No-Zero #1: Leaving out Bank Declined Parks

Many reasons exist why a financial would reject lending money toward a cellular domestic park. Playground loan providers have conditions that must definitely be found otherwise they’re going to perhaps not provide against for example attributes. Examples would include some thing really completely wrong on the possessions, your debt coverage ratio is just too low or the owner possess court issues such as for example unpermitted developments. Whenever lenders refuse a property, subsequently, cellular household playground customers have a tendency to ban them too.

One common lender rejection concern is when there will be so many playground possessed house. Of many cellular family parks available for purchase include both the playground/property by itself along with a few of the cellular home themselves. not, of many lenders cannot provide money resistant to the mobile house, however, just the homes underneath, and in case brand new park is the owner of more 20% of the land, the bank might not perform the loan anyway. Brand new resistance regarding banking institutions so you’re able to lend against the cellular property themselves is simply because cellular property dont see in the really worth consequently they are built with lower information so they never last as long and end up in disrepair smaller and easier than simply a consistent adhere built domestic.

But not, just what others deny is a window of opportunity for you! Exactly how? Basic, it allows you to definitely without difficulty discuss imaginative capital as assets does not qualify for antique cellular house park lender money. Creative financial support is easier and higher than simply needing to go through new issues away from originating a commercial financing since your borrowing and you will funds aren’t a very important factor. Second, it’s possible to improve the earnings of your own package of the selling the latest park had house for the renters. This may transition the maintenance duties on the tenants if you are either boosting your earnings (if you sell it to them on a high notice owner funded mention) or placing money into your pouch (if they can qualify for a home loan of a mobile house financial including 21st Century, Vanderbilt Mortgage and you may Are built Across the country).

Cellular Home Park Ownership No-No #2: To avoid High Vacancy Parks

Higher vacancy (also known as low occupancy) is really concerning for the mediocre cellular domestic park buyer once the most think that the playground possess lower demand or perhaps is when you look at the an adverse venue thin vacancy material can’t be fixed. In the present sensible housing drama ecosystem, in the event the a park has actually higher vacancy, than simply you can be certain that it is an administration/control disease, not a consult/area problem.

Just like the old stating goes, for many who construct it, they will become. Because costs to move a cellular household onto a playground lot is really so extremely large, looking forward to a cellular resident to go good tool on to your unused place is a pipe-dream. Instead, complete the brand new vacancies on your own with the addition of mobile house towards empty shields. Upcoming, you may either book these to renters, promote them to the a rent to possess plan or outright sell them.

The ultimate way to complete your own openings is to get this new mobile house from the leading cellular family manufacturer particularly Titan otherwise Clayton Home. Those suppliers bring lines of credit so you’re able to cellular house playground owners so that you won’t need to pay dollars to them initial. Next, they’ll motorboat the fresh new belongings in the factory direct on the property. Second, you may either rent them or even better, promote them and have the new buyer rewards brand new type of borrowing. Now the vacancy is full of hardly any money out of pocket!

Hence, try not to prevent high vacancy parks. They’re being among the most successful. The issue is perhaps not demand otherwise venue, this is the failure because of the current management/ownership not filling up the fresh vacancies. And in what way you do that is by getting the homes lead in the facility.

Mobile Domestic Playground Ownership Zero-Zero #3: Without a leave Method

Start off with the finish in mind. All park proprietor need a very clear and you will to the point get off strategy that makes reference to the program off exactly how the amazing invested capital have a tendency to be returned and how they will secure a profit. You will find essentially a couple of exit methods, sometimes to market the park at some point in tomorrow or perhaps to would a cash out refinance. Each other steps should is a plan getting improving the Online Working Earnings (NOI) and so the property value develops which your not merely get the fresh financing right back, however will also get a revenue down seriously to your possession. Raising the NOI could possibly get include filling their opportunities, reducing expenditures, raising rents or the around three.

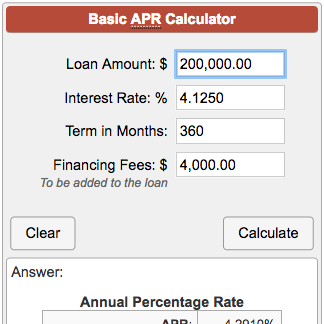

Most park people do not want to promote but would like to-do a cash-out refinance and you will consistently own the fresh new playground should they can. Government companies Federal national mortgage association and you will Freddie Mac computer has specific cellular household playground funding apps that allow you to purchase a house playing with innovative resource right after which later refinance it into their a lot of time-term 29-12 months loan. This type of are produced homes society finance are great for a couple reasons:

- They can be up to 80% LTV, which means that they need 20% off.

- You just you need a great 660 or higher credit score, so that you do not require prime borrowing from the bank.

- You are able to do a profit-aside refinance

- There are no taxation statements on it

When you yourself have a very good package, otherwise get off means, precisely how you’ll improve the NOI and you can just what financing system you will re-finance with, then you’re on your way to achieving your goals.

Biggest Zero-Zero from Owning Mobile Domestic Areas

Whether or not structuring imaginative funding, filling vacancies, broadening NOI or believed and you will performing an exit means, the biggest low-zero out-of possessing cellular home areas isnt having a teacher and you can supposed they by yourself! Therefore, score a coach! And you can get the very best cellular home park possessing mentor right here: Mobile Home Playground Trader Mentor

Leave a Reply