One which just get also delighted, know the dangers.

- Email icon

- Facebook symbol

- Facebook symbol

- Linkedin icon

- Flipboard symbol

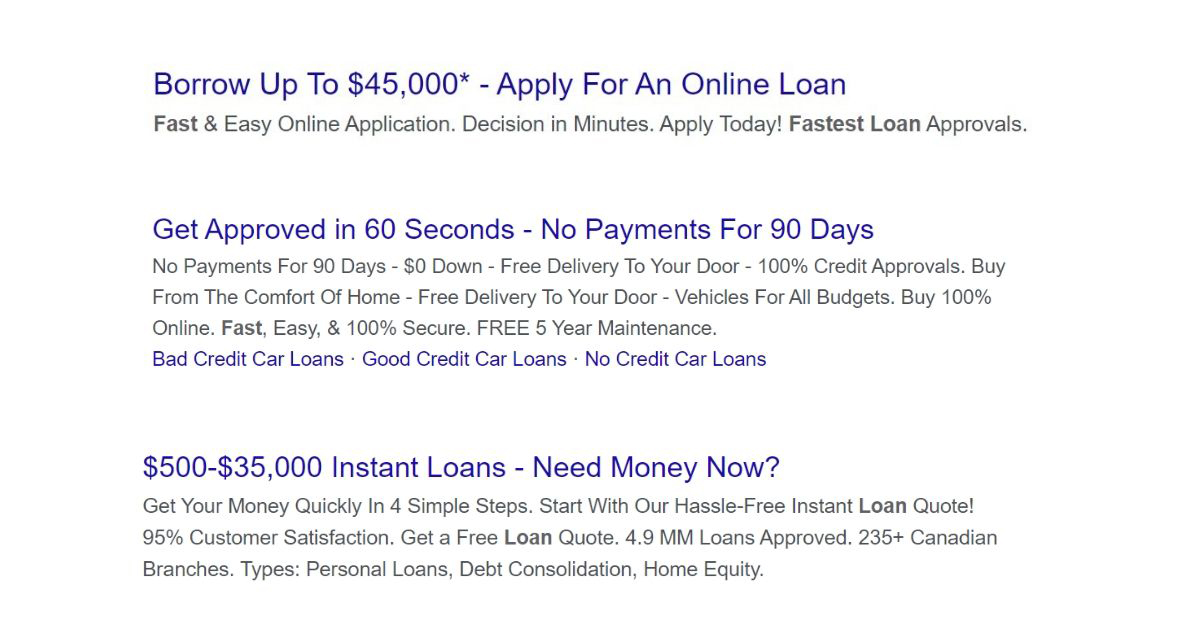

Perhaps you have obtained an effective preapproved bring regarding send that it vacation 12 months that appears instance a check, generated over to both 250 instant cash loan you and happy to dollars? Before you can rush for the bank, visions out of gift ideas moving in your head, know that it isn’t totally free dollars. Instead, its apt to be an expensive loan.

Instance prescreened mail even offers, or live inspections, try unsecured loans delivered out of finance companies or lenders to help you people just who satisfy specific standards, such as the very least credit history. Cashing this new look at goes into your into financing arrangement that may last multiple decades and then have a yearly interest rate more than 25%.

Chris Jackson received an alive check in the latest post last November getting $dos,500 having a good twenty eight% interest. Jackson, a monetary coordinator, try suspicious, however, his family unit members answered differently.

I inquired my family what they would do with [new examine], as well as they told you they’d cash it, says Jackson, founder from Lionshare Lovers, a financial believed corporation inside the Los angeles.

They explained so it is sweet to have additional bucks for the holidays. However it is maybe not dollars, while the price is actually tough than just credit cards, says Jackson.

Live monitors: The expenses and dangers

Most loan providers that offer real time checks dont consider carefully your occupations status, earnings or power to pay a unique financial obligation. Often, the fresh loans was unaffordable to possess consumers who possess other expenses to help you pay, states Carolyn Carter, deputy director at National Individual Rules Cardiovascular system, an excellent nonprofit user advocate organization.

Pushing borrowing from the bank to the some one once they haven’t in fact required they can merely lead them to being overextended, Carter claims.

U.S. senators Doug Jones (D-Ala.), Tom Cotton fiber (R-Ark.), and Jeff Merkley (D-Ore.) delivered laws and regulations to get rid of what they phone call the latest predatory behavior from mailing alive monitors in order to users. The latest Unsolicited Loan Act regarding 2018, lead Dec. 10, would make certain that consumers get financing on condition that it submit an application for her or him. The new senators propose to force the balance forward inside the 2019.

Mariner Finance sends alive checks with rates doing 36 per cent. Inside the 2017, Regional Financing sent more than six mil real time checks and obtained an average produce from 42% for the quick financing ($five-hundred in order to $2,500), plus alive monitors, considering its annual statement.

- Borrowing from the bank insurance policies, also called fee protection insurance policies, is actually a choice which covers the borrowed funds harmony if you can’t repay on account of passing, unconscious jobless otherwise impairment. Its an unnecessary costs in case the borrower currently provides life or handicap insurance coverage, Jackson claims.

- Refinancing is given if you fail to pay the borrowed funds. You have made extra money and a longer fees label, and also more desire and you may potentially an origination percentage.

- Attorney fees is energized for those who default to your financing. Such as costs, the expense of which may differ by county, defense the fresh new lender’s costs out-of pursuing suit up against you.

What you should do if you get an alive have a look at

Look into the lender. Verify that the lender is authorized doing team on your state during your country’s lender regulator. Check out the Consumer Financial Security Agency grievance databases to find out if the lending company possess grievances.

Have a look at loan contract. Knowing the loan’s prices and terminology support determine their affordability. The newest agreement would be to outline the yearly cost of credit, depicted given that an apr and you will as well as attract will cost you and you can fees; how many required costs; and you may payment wide variety.

Shop aroundpare personal bank loan pricing and you may words during the credit unions, banking companies an internet-based loan providers. When you yourself have less than perfect credit, you might be able to find all the way down prices on federal credit unions, hence limit prices on funds within 18%. You may look at rates and you may terminology during the on line lenders. Really work at a softer pull on your own borrowing, without any impact on your credit rating.

Manage much time-label choices. Create a spending budget you to tracks your purchasing, that can select a lot of purchasing which help you pay regarding loans or head money so you can an emergency finance. You may then use dollars to possess issues unlike highest-interest borrowing from the bank.

Split it up. Shred and put the latest sign in new garbage otherwise require the offer. You are able someone you’ll deal the glance at, signal and cash it on your own title. Numerous individual issues at CFPB stress the identity-theft chance of live checks.

Leave a Reply