Inside the most recent five-12 months several months, 93 percent regarding Clayton’s cellular lenders got such high priced terms and conditions which they called for even more disclosure around government laws and regulations

Vanderbilt, one of Clayton’s lenders, approved their unique to own an excellent $sixty,000, 20-season loan to purchase a good Clayton home at percent annual focus.

Mansfield’s payment out-of $673 consumed many her protected income. Within this eighteen months, she is at the rear of towards the money and you can Clayton try trying foreclose with the home and you can property.

Many consumers questioned for it studies demonstrated becoming steered from the Clayton people into Clayton financing instead of recognizing the companies had been one and an identical. Both, consumers said, the newest agent discussed the financing just like the cheapest price available. Other days, the newest Clayton specialist told you it absolutely was the only capital option.

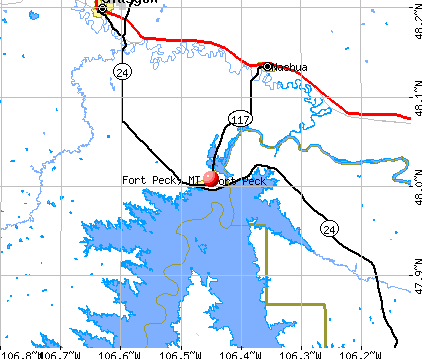

Clayton’s Oakwood Belongings specialist from inside the Knoxville informed Tim Smith one Vanderbilt are alone who would manage to perform some contract, Smith said. His put domestic turned up a month after, long after Smith got exchanged in his previous domestic since a good down-payment, the guy said. The brand new Clayton company exactly who produced the house would not haul it within the slope, Smith told you, except if Smith took aside a preliminary-title, high-focus payday loan to fund an unexpected percentage.

Kevin Carroll, former holder regarding a good Clayton-associated provider for the Indiana, said within the a job interview which he used business loans regarding an effective Clayton bank to finance list for their lot. If the he and additionally guided homeowners to do business with a comparable bank, 21st Mortgage, the company would give him a benefit on his loans – a beneficial kickback, within his terminology.

Doug Farley, who had been a standard movie director at several Clayton-possessed dealerships, also utilized the title kickback to describe the profit-show the guy obtained to your Clayton loans up until doing 2008

Then, the organization altered its incentives in order to as an alternative render kickbacks toward sales out-of Clayton’s insurance policies so you can individuals, he said.

Ed Atherton, a former package director during the Arkansas, told you their regional manager was forcing package managers to place within minimum 80 % of consumers to the Clayton financial support. Atherton remaining the firm inside 2013.

Users said in interviews one dealers tricked these to deal with unaffordable finance, having systems and additionally busted pledges, last-time transform to help you loan words and you can unexplained charge that fill mortgage balances. For example finance are, because of the definition, predatory.

They are going to guess the customer are unsophisticated, and they’re correct, told you Felix Harris, a homes specialist with the low-funds Knoxville Town Metropolitan Group.

Particular individuals told you it experienced caught up because they set up a beneficial put till the broker explained the loan terms otherwise, such as the Ackleys, felt forced to take bait-and-option purchases because they got spent thousands to prepare the home.

A couple of decades after getting into their brand new mobile domestic in Ephrata, Washington, Kirk Ackley are harmed inside the an excellent backhoe rollover. Unable to performs, he along with his partner urgently wanted to refinance this new expensive 21st Real estate loan it regretted finalizing.

It pleaded and their lenders from time to time on the most useful words americash loans Fleming that they in the first place were promised, but have been refuted, they told you. The new Ackleys attempted to give an explanation for options inside the a call having a twenty-first supervisor: If they refinanced to reduce repayments, they could stay in the home and 21st carry out score years from steady output. If not, the firm will have come-out on the outlying possessions, pull our home from its foundation and you will transport they out, possibly destroying they into the repossession.

It said these were perplexed by reply: Do not care. We shall started need a chainsaw so you can they – cut it up-and haul it in the packages.

Leave a Reply