Much of their 800 teams are employed in their Wonkaville as well as an enthusiastic outpost when you look at the Kentucky, getting into dated-university stuff like mortgage repair and you will contractor recruiting. Some fintech lenders use thousands of investigation points, of senior years https://www.paydayloanalabama.com/ozark discounts and you will school stages to social networking connections, to judge the brand new riskiness out-of would-end up being individuals (select container, below). We are very old-fashioned. There’s nothing exotic, Zalik claims. It should be as well as predictable for the bank people. Tim Spence, the principle approach administrator on 5th 3rd, concurs: I watched vision so you’re able to vision with GreenSky because it associated with the type of the borrower. An alternative brighten: GreenSky gives the bank the new matchmaking that have desirable customers to help you whom it does mountain most other things.

If the requirements are simple, the fresh delivery would be way more. GreenSky’s creative design depends on sales agents on the floor just who athletics device straps and you can Timberlands, maybe not MBAs. Therefore, Zalik’s pride and you may contentment, the GreenSky cellular app, makes use of what the founder phone calls the new body weight flash laws-all setting you can certainly do on the a smartphone otherwise tablet using one to highest little finger.

However they claim in a federal suit that they had been amazed to learn-following the builder had currently tapped the money-that in case it didn’t repay the borrowed funds inside men and women 18 weeks, they would owe straight back appeal out-of date that

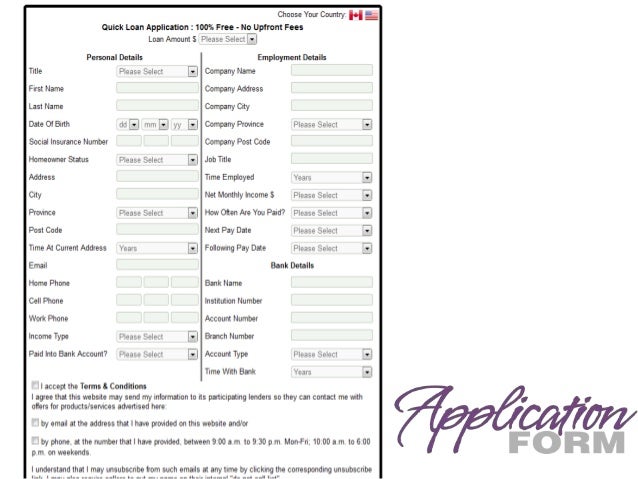

A builder or their salesman was resting from the a prospective customer’s dining table revealing the newest window otherwise a pool. To close the offer-or encourage a person he is able to manage particular items-he offers capital. He scans the brand new customer’s driver’s licence into software, then delivers his product and you will asks your ex lover to go into simply around three affairs: Earnings, personal coverage amount and you may phone number. Particular 95 percent regarding possible consumers score a decision to your destination. Recognized money increase so you’re able to $65,000, on the specific terms and conditions influenced by the borrower’s borrowing, your options brand new builder elects provide and you will subsidise, additionally the choice an individual selections.

But GreenSky nonetheless confronts the type of courtroom headaches which can be inevitable in the event that individual that pitches the mortgage as well as receives the continues

This new specialist is additionally responsible for working out a cost agenda having subscribers. Brand new GreenSky financing cash is taken to the new company particularly good typical mastercard fee, thru LearnCredit rails, plus the builder can be tap money-on borrower’s agree-to have in initial deposit, getting have commands otherwise whenever some completion objectives was satisfied.

The greatest attract to own customers: Zero-appeal investment to possess a promotional ages of 6 to help you 2 yrs. A lot of GreenSky’s individuals you should never shell out a dime into the attract while they pay the balance throughout that period. However, if they won’t, these are typically to the hook on deferred attract, in the pricing between 17 percent to 23 per cent. Property owners exactly who care they cannot pay back the loan about advertising and marketing several months normally opt as an alternative getting a diminished repaired rates-generally 5 % in order to eight per cent. Individuals in addition to usually spend an excellent $39 settings fee, which would go to the banks.

Zalik’s company model lets GreenSky to cease many deals can cost you one burden almost every other on the web lenders, including direct-mail. And its particular bank financing have enjoy they to stop people come out regarding Financing Club’s entryway a year ago that it sold fund to help you a trader you to failed to fulfill the client’s standards.

Eg, when Todd and you may Sylvia Alfortish wanted to place solar panels for the the fresh new roof of its Louisiana domestic within the 2015, people say they certainly were advised it might all the way down its month-to-month utility expenses and there was no interest on the $ten,000 loan on the first 1 . 5 years. (The newest legal provided GreenSky’s request so you can kick happening to help you arbitration, as the loan plans wanted. GreenSky, while decreasing so you can comment on individual cases, states the consumers discovered its mortgage records in america post and can also receive them on the web.)

Leave a Reply