Links are made to ensure anybody can overcome obstacles and just have in which they would like to wade. In the wonderful world of a property otherwise organization, connection money is not any other.

Tend to utilized by companies to keep up with income means whenever you are waiting for a lot of time-label funding, a so-named connecting loan is employed to cease a money crisis. Having personal customers and you will household, link investment is generally set aside for facts involving the purchase or revenue of a property. Including, for individuals who very own property and are attempting to sell they to get a separate you to definitely, but personal the offer on brand new home before you signed new selling for the history one, after that a bridge loan makes it possible to shelter their costs when you look at the the fresh interim.

A brief publication will explain how a link financing functions, the benefits and downsides associated with version of quick-identity investment, including suggestions in order to safer link financing, should the you need develop.

Bridge Money

This type of equity money enjoys a role to try out any day discover a disconnect between a request getting money and you can its access.

Particularly, bridge fund assist people control their property guarantee and also make a beneficial advance payment and or romantic on the a different sort of domestic as they expect the newest the place to find sell. Because the most of people need the proceeds from the fresh selling of the current where you can find keep the purchase of an alternate one, domestic collateral connection investment support some one beat so it monetary challenge.

Deteriorating Bridge Loans

Popular into the scorching areas, link finance usually help some one take advantage of positive a house business requirements or possibilities to pick a house that they create struggle to afford without any product sales of their newest property.

Loan providers provide connection investment due to the fact an initial-term option to overcome an otherwise insurmountable financial challenge. As the property philosophy still climb, balancing several mortgage loans is simply not realistic for many people, thus link funds, when it comes to a first mortgage otherwise 2nd mortgages , are very an ever more popular option for visitors to perform financial repayments and or romantic on their buy.

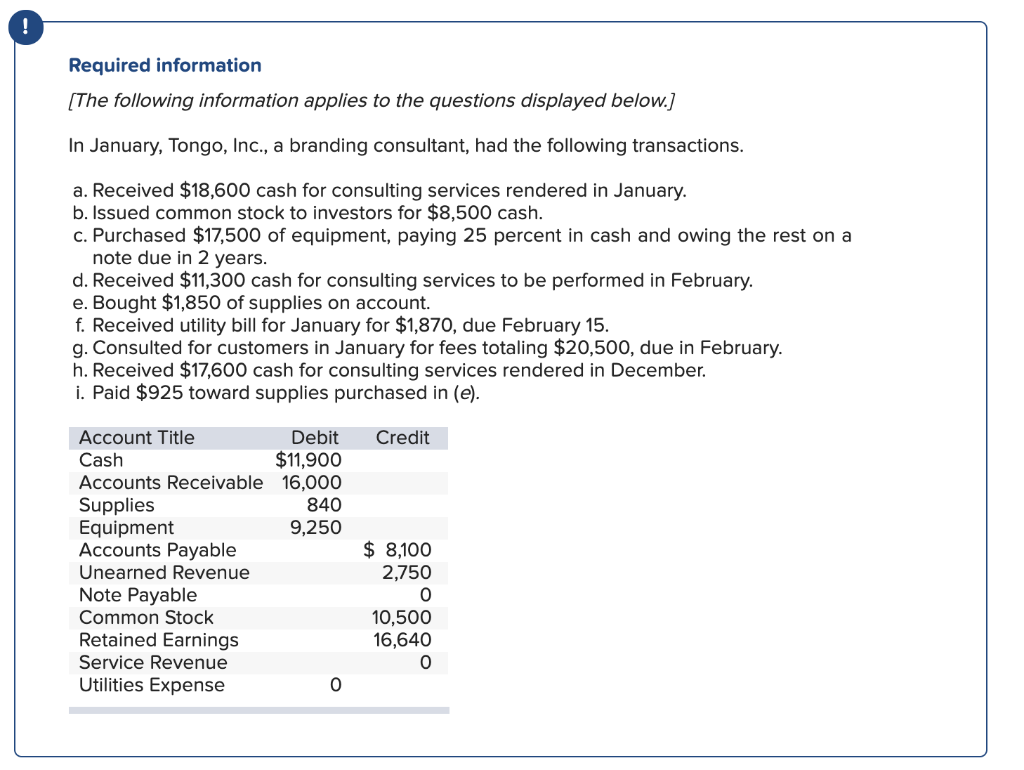

Connection Financial support Conditions & Will set you back

Some lenders wanted a firm selling arrangement positioned for your current home. In case the house is ended up selling firm, your own mortgage broker probably won’t have much issue having the financing you should protection the fresh advance payment and you may settlement costs to have the acquisition of the brand new home in the form of an effective link financing.

The newest link loan interest levels your large financial company could possibly get rely into the multiple affairs, together with your credit rating, debt so you’re able to income ratios, additionally the connection loan amount. Interest rates because of it particular brief financial support basically are normally taken for the top speed doing nine%.

At the top of focus repayments, obtaining connection investment means that borrowers must spend the money for will cost you regarding the closure their earliest mortgages, also every payday loans no credit check in Rock Creek Park CO courtroom and administrative charges.

Connection Mortgage Pros and cons

Bridge investment is best solution if you have a disconnect within closing dates off a home deals and you will people you prefer the continues of one’s marketing of the existing property so you can safe the acquisition of the upcoming home. Bridge financing positives are:

- Quick access to money

- Provides consumers greater freedom and much more options for a property orders

- Less application procedure than antique funds

- Getting home owners, more time to offer their present house will bring comfort and minimizes fret

A connection mortgage is a good idea in many issues, but, just like any brand of resource, he’s got particular drawbacks, including:

- Broad variability in criteria, can cost you and you can terminology

- Interest levels might be more than together with other types of investment

- Possibly high-risk, particularly without a strong deals contract, since the a residential property deals commonly guaranteed up to they are signed

- Perhaps not a selection for the residents because loan providers need the absolute minimum quantity of home security

- Debtor need to pay costs associated with the newest link mortgage also as their newest financial

The newest Tribecca Virtue

We don’t need a strong sale of your home and then we promote one another first-mortgage and you will 2nd mortgage connection finance. Maintain expenses in balance we can use the focus cost toward financing and that means you don’t possess attention payments during the the definition of of one’s connection loan. All of our connection funds try discover and no prepayment punishment and we promote some of the reduced rates of interest within the Ontario.

When you have questions regarding link resource alternatives, the credit gurus at Tribecca makes it possible to take a look at the options. Click the link add a question otherwise phone call 416-225-6900.

Leave a Reply