Yes, you can aquire home financing with the maternity exit. Here’s how

The last thing we wish to worry about is whether or not otherwise maybe not you’ll end up acknowledged for your home loan while on pregnancy leave.

Fortunately, loan providers legitimately cannot refute your a home loan as the you may be to-be good father or mother. However you might have to plunge due to a lot more hoops to track down accepted.

This is because, to your pregnancy get off, you might be getting limited money to have a period of time. So that as lenders view it, there can be a chance you do not come back to the new staff members.

What you should know about maternity leave and you can financial recognition

In order to be accepted to have an interest rate, loan providers commonly assess your income, assets, and you will obligations. This is actually the just like they would which have any kind of home loan candidate.

They along with take into consideration if for example the maternity get off is paid down or outstanding, as well as the time you plan to go back to the office.

In general, paid off are better than unpaid, and most lenders really wants to get a hold of evidence you will return to performs within this 1 year.

Pregnancy exit typically ought not to prevent you from being qualified for an excellent household, but you should comprehend the implications of your get-off big date.

Would I have to give my home loan company I’m expecting?

Their mortgage lender is not permitted to ask whether you’re pregnant otherwise to your maternity get-off if you’re applying for a good home loan.

However, loan providers must make sure you can meet your repayments on your own financing rather than high pecuniary hardship. It means they could ask you to answer if or not you expect people changes into situations in the future.

Mortgage brokers commonly allowed to query whether you’re pregnant or to your pregnancy exit. not, he or she is greeting (indeed, required) to ensure latest and you may future a career position and earnings.

Therefore the costs associated with a baby – aside from the new ongoing will cost you out of taking care of an infant – could improve expenditures. Your ability and come up with home loan repayments may likely become influenced.

For many who standard on your financial, you will end up more influenced. Therefore, its in your best interest the thing is along with your home loan company.

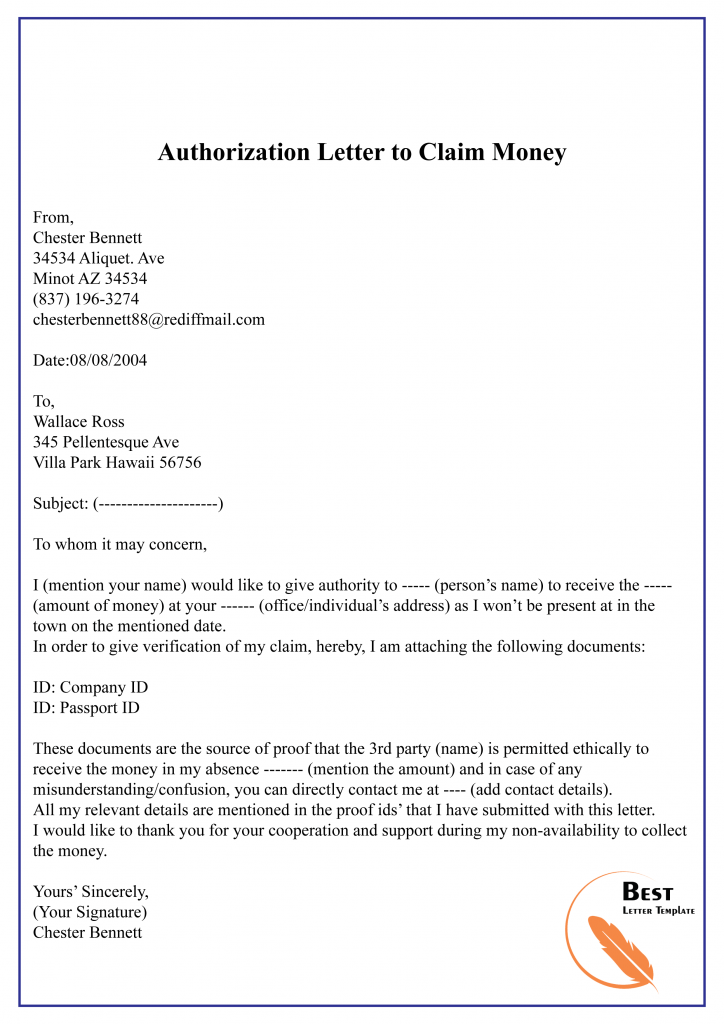

Just what documentation is needed throughout pregnancy exit?

- Render an effective W2 tax slip on the 12 americash loans Blue River months just before maternity hop out (having salaried staff only)

- Promote a letter confirming your a career one states once you were hired, once you anticipate back again to really works as well as your yearly income

If you are repaid each hour, just how many days you functions weekly should be integrated. Whenever you performs overtime apparently, you could promote records regarding the early in the day 2 yrs showing consistency.

Possibilities when taking place pregnancy exit

FHA guidance create allowances for the temporary get off of lack along with pregnancy hop out. And when the fresh new borrower’s purposes should be come back to performs, you’ll find exclusions.

In case the home loan begins once pregnancy log off

To possess property owners which propose to come back to manage otherwise prior to the original normal mortgage repayment is made, the financial institution uses the fresh new pre-leave money matter.

Should your home loan begins throughout the maternity leave

In the event the borrower intends to go back to performs pursuing the earliest typical home loan due date, the lending company normally opinion current water reserves.

A choice can be produced if they have enough readily available bucks reserves to behave because the a hold finance toward 90 days where in fact the debtor intends to become underemployed.

- Give an authored declaration from the individuals saying the latest intent in order to go back

- Document new employer’s welcome out-of a career after pregnancy log off

- Ensure sufficient possessions to shut and additionally more money

Lenders dictate readily available cash supplies pursuing the mortgage has closed together with new down payment amount and you will settlement costs. Remaining money would be during the a water membership open to the fresh borrowers.

That it formula is employed whether your loan commonly intimate therefore the first percentage due before the individual production to operate.

As to why maternity log off impacts home loan acceptance

Maternity exit make a difference to the degree of earnings a single otherwise couples is anticipated to get. In turn, this has an effect on their residence to buy budget. Is as to the reasons.

Once you make an application for a mortgage, lenders take a look at earnings for the most recent two years off employment. He’s selecting uniform money, together with possibilities that income will continue. Maternity log off can impact one opportunities.

Mortgage lenders seek consistent money, additionally the chances the income is going to continue. Maternity exit can affect one to likelihood.

Such, when two people apply for an interest rate to one another, the lending company can add up money out of for qualifying motives.

The mortgage brokers will request your a few current paycheck stubs covering an one month months along with a couple of latest W2 versions.

The difficulty to own a home loan company appear when that couples are pre-approved considering its monthly money from $eight,000, but there is however a pregnancy involved.

In the event the lady that is taking time off for maternity and you may is not choosing people monthly money throughout that several months, exactly what selection really does the lending company possess?

At all, in the event your lady intends to take off eight days to your delivery and you can proper care of her child, being qualified money is reduced.

That’s why you often have to display documents saying the agreements to go back to get results, as well as your employer’s purpose to help you uphold your own pre-hop out salary.

A note to the Nearest and dearest and you can Scientific Log off Act and you will financial qualifying

The amount of income you get during the maternity get-off all depends on your own boss, and you can possibly towards state you live in.

For those who benefit a buddies with at the very least fifty professionals, this new boss need to follow your family and you may Scientific Get-off Work.

If the employee has been employed by a similar team to possess no less than 12 months with the absolute minimum 24-hour works few days, the brand new manager must stick to the Act’s legislation, primarily because it means the latest worker returning to really works immediately following maternity leave.

And additionally back into performs, the company need certainly to still provide the same benefits because the individual into the to the pregnancy get off and medical health insurance.

The quality name to possess pregnancy get off was from six to help you 7 days. This period is part of new twelve workweeks per year enjoy towards proper care of the little one in the first 12 months.

Getting small businesses that don’t have at least 50 personnel in one area, they are not necessary to follow the Nearest and dearest and you may Scientific Leave Act.

When you look at the California, for example, feminine normally collect brief county impairment payments and that amount to just as much as two-thirds of their wages in the six to eight few days months.

Make sure you check with your employer’s Hours department otherwise state resources to verify what your lingering masters would-be while on get off.

See if your qualify for a mortgage, even when believe pregnancy log off

Enquire about for every single lender’s policies. To check out a loan officer which is proficient in this area, who’ll not just offer reasonable investment but is including simple to do business with.

Leave a Reply