HomeReady ‘s the term of Fannie Mae’s step 3% advance payment home loan. Its a reasonable financial program getting very first-go out homebuyers which is along with accessible to recite buyers and present homeowners for re-finance.

Fannie mae circulated HomeReady for the 2014. The applying changed new agency’s MyCommunity Home loan program, that has been restrictive and you will restricting. HomeReady created the newest, versatile, sensible homeownership alternatives for low- and average-income people; permits getting the very least down-payment of step 3% and subsidizes financial cost and you will financing costs.

That has entitled to the new Federal national mortgage association HomeReady financial?

- You ought to reside our home you happen to be financing. HomeReady is for no. 1 residences simply. Homebuyers are unable to use it to finance a vacation domestic, Airbnb possessions or other form of investment property. Co-signers are permitted, as well as least one individual on the financial need certainly to live throughout the possessions.

- Your home should be a home. HomeReady is for attached otherwise detached single-family relations homes, plus townhomes, apartments, rowhomes and you can multi-device house regarding four devices or a lot fewer. Were created home is generally eligiblemercial properties are not anticipate.

- Their financial need meet compliant mortgage guidelines. HomeReady try a fannie mae mortgage program, which means that money need see Fannie Mae’s conforming financial guidelines. Financing items must be within this local compliant financing limits, people should provide evidence of earnings and you may fund can’t be attract-merely.

- Your deposit need to be at the least 3%. HomeReady lets financing-to-worth (LTV) up to 97 per cent of your own price. Customers need certainly to create the very least step three% down payment, which could come from any eligible origin. Eligible offer were bodies down payment assistance programs, dollars gifts out-of relatives otherwise loved ones, dollars features and you can funds.

- Your income need to be substandard for your census tract. Home income for HomeReady people will most likely not exceed eighty % out-of the newest average house earnings about residence’s census system. Home buyers whom secure money to possess HomeReady have access to other low-down commission money, such as the Traditional 97 program while the FHA step three.5% advance payment mortgage.

- You will possibly not owe money on more than one other mortgaged home. HomeReady allows home buyers for a financial need for one most other mortgaged possessions, and this can be a vacation domestic, short-term local rental property otherwise a financial investment. There are not any restrictions on the commercial possessions financial investments.

- You really must have a credit rating from 620 or maybe more. HomeReady needs the very least credit rating regarding 620 for 1-device and you may multi-device belongings. Fannie mae spends new FICO credit reporting system, hence ignores scientific loans and collections.

- You must sit in an excellent homeownership knowledge class. Federal national mortgage association need very first-time homeowners to-do good homeownership education direction included in an excellent HomeReady approval. The mortgage company has the benefit of an internet instructional way called HomeView during the free of charge. Homeownership training reduces financial standard chance by 42%.

HomeReady money restrictions

Federal national mortgage association written HomeReady inside 2014 to greatly help lowest- and moderate-income clients get to their American Dream of homeownership, in which reduced-to-modest earnings is understood to be making less yearly money than their nearest neighbors.

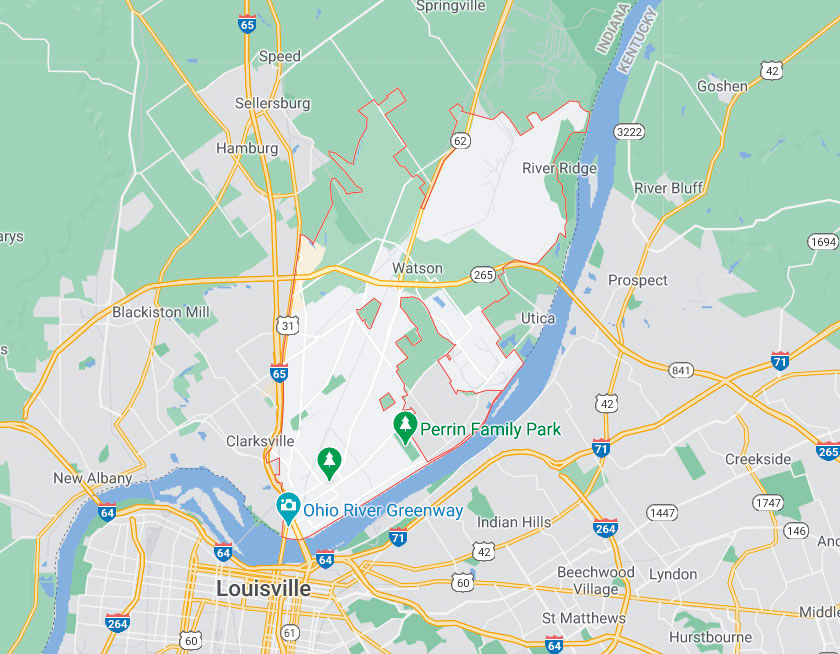

HomeReady homeowners will most likely not earn more than 80% of the the brand new home’s census tract’s money. Fannie mae can make money constraints available on its website because found less than.

HomeReady can be used from inside the town, residential district and you will rural portion. It lowers downpayment standards to three%, drops home loan rates in order to inexpensive accounts, and you may makes owning a home less, quicker and easier.

HomeReady, connection dwelling units (ADU) and boarder income

When Fannie mae first established its HomeReady financial within the 2014, the fresh new agencies advertised the applying as home financing getting multiple-generational households. It let boarder earnings regarding mothers, grand-parents, and you will people, every traditions in one place and you will adding to monthly payments.

The application form lengthened decade later to allow connection dwelling devices (ADU). An item product try an area which have a cooking area and you will an excellent restroom within this a new house, usually along with its own entrance. Attachment products tends to be regarding basement, above the garage otherwise connected to the subject possessions. ADUs can also be independent land to the residential property out of a keen present property.

That have boarder earnings, customers are able to use money acquired, dollars-for-buck, as the earnings with the the mortgage. Proof commission is when it comes to canceled monitors, Venmo or other electronic transmits, otherwise bank comments indicating dumps to the a checking account.

Income away from accessory dwelling products cannot be put buck-for-dollars because the income towards a credit card applicatoin. Lenders will deduct 25% out of rent accumulated towards the an enthusiastic ADU to help you take into account vacancies and you will can cost you. Homeowners try recommended, but not requisite, to make use of finalized lease preparations indicating its leasing income.

HomeReady mortgage prices and you may home loan insurance policies

Good HomeReady consumer that have an average credit rating gets the means to access mortgage pricing 0.twenty five payment circumstances less than simple conventional cost. Customers with high credit scores found costs discounted by as frequently because the 0.75 payment items.

While doing so, HomeReady deals private financial insurance rates to have qualified customers. An average HomeReady resident will pay shorter having PMI and you will conserves multiple of cash on mortgage insurance policies per year.

Due to the fact Federal https://paydayloansconnecticut.com/greens-farms/ national mortgage association coupons home loan costs and personal financial insurance rates, HomeReady homebuyers save yourself around $700 each $100,000 borrowed a year as compared to fundamental financial individuals.

Leave a Reply